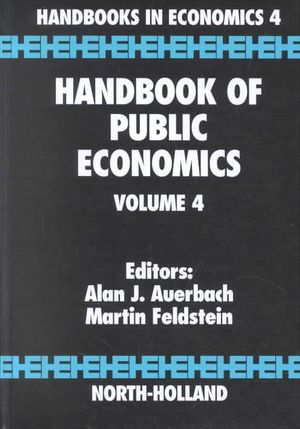

At a Glance

702 Pages

23.4 x 15.6 x 3.18

Hardcover

RRP $241.95

$214.75

11%OFF

or 4 interest-free payments of $53.69 with

orAims to ship in 5 to 10 business days

For more information on the Handbooks of Economics series, please see our homepage on

Industry Reviews

| Introduction to the Series | p. v |

| Contents of the Handbook | p. vii |

| Editors' Introduction | p. xv |

| Theory of Public Goods | p. 485 |

| Introduction | p. 485 |

| Pure public goods | p. 486 |

| Generalizations | p. 491 |

| Negative benefits | p. 492 |

| Public intermediate goods | p. 493 |

| Distortionary taxation | p. 495 |

| Externalities | p. 496 |

| Congestion | p. 499 |

| Club goods and local public goods | p. 502 |

| Private provision of public goods | p. 509 |

| No exclusion, small number of participants | p. 509 |

| No exclusion, large number of participants | p. 514 |

| Exclusion possible, large number of participants | p. 515 |

| Exclusion possible, single seller | p. 518 |

| Public sector provision of public goods | p. 522 |

| Pigouvian taxes and subsidies | p. 522 |

| Information | p. 524 |

| Behavior of public officials | p. 530 |

| Directions for further research | p. 533 |

| References | p. 533 |

| Incentives and the Allocation of Public Goods | p. 537 |

| Introduction | p. 537 |

| Implementation | p. 538 |

| Dominant equilibrium: c = d | p. 540 |

| Bayesian-Nash equilibrium | p. 540 |

| Maximin equilibrium: c = m | p. 541 |

| Nash equilibrium: c [identical with] n | p. 541 |

| Local dominant equilibrium | p. 543 |

| The Gibbard-Satterthwaite theorem | p. 545 |

| Public goods only; positional dictators | p. 550 |

| The differential approach | p. 551 |

| The Clarke-Groves-Vickrey mechanisms | p. 554 |

| Weakening incentives requirements | p. 559 |

| Planning procedures | p. 561 |

| Local dominant equilibrium | p. 561 |

| Local maximin equilibrium | p. 566 |

| Conclusion | p. 567 |

| References | p. 567 |

| The Economics of the Local Public Sector | p. 571 |

| Introduction | p. 571 |

| Community formation and group choice | p. 574 |

| A starting point - the theory of clubs | p. 576 |

| Optimum club size with congestion | p. 580 |

| The Tiebout model | p. 581 |

| Allocating individuals with different incomes | p. 581 |

| The property tax | p. 583 |

| Production inefficiencies in the Tiebout model | p. 585 |

| Will an equilibrium exist? | p. 587 |

| Capitalization of public spending and taxes in a Tiebout framework | p. 591 |

| The efficiency of the Tiebout model with capitalization | p. 597 |

| Testing the Tiebout model | p. 598 |

| Empirical determination of the demand for local public goods | p. 601 |

| Introduction | p. 601 |

| Empirical issues | p. 606 |

| Some additional empirical issues | p. 609 |

| Estimating demand functions in a Tiebout world | p. 612 |

| Applications of the demand approach | p. 614 |

| Alternative methods for estimating the demand for local public goods | p. 614 |

| Will the median level of services provided be efficient? | p. 622 |

| Fiscal federalism | p. 625 |

| The responsibilities of local government | p. 625 |

| The role of grants in a federalist system | p. 634 |

| Conclusions | p. 637 |

| References | p. 639 |

| Markets, Governments, and the "New" Political Economy | p. 647 |

| Introduction | p. 647 |

| Market failures and the role of government | p. 649 |

| The minimal role of government | p. 650 |

| Beyond the minimal state: When markets fail | p. 653 |

| Market failures as a Prisoner's Dilemma: The potential case for government | p. 663 |

| Summary | p. 672 |

| The search for efficient government | p. 672 |

| Collective action as voluntary exchange | p. 674 |

| Coercive mechanisms of collective choice: Democracy vs. efficiency | p. 681 |

| Dictatorial processes: The dictator as a benevolent planner | p. 692 |

| Democratic processes | p. 703 |

| Summary | p. 738 |

| Public policies for the public sector | p. 739 |

| On designing policies for government reform | p. 740 |

| An example: Constitutional limitations for government efficiency | p. 743 |

| Summary | p. 753 |

| Conclusion: Drawing the borderline between markets and governments | p. 753 |

| Addendum | p. 765 |

| References | p. 769 |

| Income Maintenance and Social Insurance | p. 779 |

| Introduction | p. 779 |

| Objectives | p. 785 |

| Income support and the abolition of poverty | p. 785 |

| Measurement of poverty | p. 789 |

| Welfare economics and social welfare functions | p. 791 |

| Concluding comment | p. 795 |

| The design of state income maintenance | p. 795 |

| A simple model | p. 795 |

| Income support - individualistic preferences | p. 799 |

| Ethical preferences | p. 803 |

| Social insurance and intertemporal allocation | p. 807 |

| The form of income support | p. 811 |

| Concluding comment | p. 815 |

| The impact in practice | p. 815 |

| Complex budget constraints | p. 815 |

| Non-receipt of benefits | p. 820 |

| Benefits, taxes, and poverty | p. 822 |

| Overall redistributive effect | p. 826 |

| Political economy of income support | p. 829 |

| Concluding comment | p. 833 |

| Effects on economic behaviour | p. 833 |

| Income support and its effect on retirement decisions | p. 834 |

| Disability benefits and participation | p. 847 |

| Unemployment insurance and work decisions | p. 851 |

| The take-up of welfare/public assistance | p. 865 |

| Income support and family formation | p. 868 |

| Pensions and savings | p. 869 |

| Concluding comments | p. 880 |

| Reforms and simulation of their implications | p. 880 |

| Specification of effects of reforms and hypothetical examples | p. 881 |

| Modelling using representative samples | p. 883 |

| Incorporation of changes in behaviour | p. 884 |

| General equilibrium effects | p. 887 |

| Envoi | p. 889 |

| References | p. 889 |

| The Theory of Cost-Benefit Analysis | p. 909 |

| Basic principles | p. 909 |

| Introduction | p. 909 |

| Project evaluation, cost-benefit analysis, and shadow prices | p. 910 |

| The basic theory of shadow prices | p. 912 |

| Shadow prices and optimal public production | p. 916 |

| Cost-benefit analysis and the theory of reform | p. 918 |

| Lessons from second-best theory | p. 920 |

| The model | p. 921 |

| General properties of the model | p. 926 |

| Some important second-best theorems | p. 937 |

| Shadow prices in distorted economies | p. 945 |

| Conclusion | p. 953 |

| Selected applications of the theory | p. 954 |

| Introduction | p. 954 |

| The distribution of welfare | p. 955 |

| Traded and non-traded goods | p. 961 |

| Shadow wages | p. 964 |

| Numeraires, discount rates, and foreign exchange | p. 967 |

| Private projects and Boiteux firms | p. 976 |

| Uncertainty and time | p. 977 |

| Some neglected issues | p. 980 |

| Summary and conclusions | p. 982 |

| References | p. 985 |

| Pareto Efficient and Optimal Taxation and the New New Welfare Economics | p. 991 |

| Introduction | p. 991 |

| One-commodity neoclassical models | p. 993 |

| The basic model | p. 993 |

| Optimal lump-sum taxes | p. 994 |

| Imperfect information | p. 996 |

| Implementing the optimal allocations by means of a tax structure | p. 1002 |

| The optimal tax structure with [lambda subscript 2] > 0, [lambda subscript 1] = 0 | p. 1003 |

| The optimal tax structure with [lambda subscript 1] < 0, [lambda subscript 2] < 0 | p. 1005 |

| Equity-efficiency trade-offs | p. 1006 |

| Continuum of individuals | p. 1006 |

| Some mathematical problems | p. 1008 |

| Non-differentiability | p. 1009 |

| Discontinuities | p. 1011 |

| Generalizations: Random taxation | p. 1011 |

| Limitations: Restricted taxation | p. 1014 |

| Limitations: The push-pin versus poetry controversy | p. 1017 |

| Limitations: General equilibrium effects of taxation | p. 1019 |

| Other limitations on the general model | p. 1021 |

| Numerical calculations | p. 1022 |

| Pareto efficient taxation with many commodities and many periods | p. 1023 |

| Alternative tax bases | p. 1023 |

| Formal analysis | p. 1024 |

| Ramsey versus Atkinson-Stiglitz Pareto efficient taxation | p. 1026 |

| Redistributive commodity taxes with optimal linear income taxes | p. 1027 |

| Other forms of restricted taxation | p. 1029 |

| Implications for capital taxation | p. 1030 |

| Overlapping generations models | p. 1031 |

| Infinitely lived individuals | p. 1032 |

| Imperfect capital markets | p. 1034 |

| Altruism and inheritance taxation | p. 1034 |

| Commitment | p. 1035 |

| Concluding comments | p. 1036 |

| Optimal taxation in non-neoclassical economies | p. 1036 |

| Concluding remarks | p. 1037 |

| References | p. 1039 |

| Tax Incidence | p. 1043 |

| Introduction | p. 1043 |

| Preliminaries | p. 1045 |

| The partial equilibrium analysis of tax incidence | p. 1045 |

| Methodological issues | p. 1047 |

| Empirical incidence evaluations | p. 1049 |

| Static general equilibrium models of tax incidence | p. 1050 |

| Tax incidence in a one-sector general equilibrium model | p. 1050 |

| Tax incidence in a two-sector general equilibrium model | p. 1054 |

| Estimate of tax incidence in static general equilibrium models | p. 1063 |

| Tax incidence in open economies | p. 1065 |

| A simple model of factor mobility | p. 1065 |

| Further implications of the simple open economy model | p. 1067 |

| Incidence of the property tax | p. 1068 |

| Dynamic models of tax incidence | p. 1070 |

| Tax incidence in a life-cycle, overlapping generations model | p. 1071 |

| Income effects with intergenerational altruism and the possible neutrality of intergeneration transfers | p. 1078 |

| Transition effects | p. 1079 |

| Asset prices and tax incidence | p. 1082 |

| Conclusion | p. 1088 |

| References | p. 1088 |

| Corrigendum | p. 1093 |

| Index | p. 1095 |

| Table of Contents provided by Ingram. All Rights Reserved. |

ISBN: 9780444823151

ISBN-10: 0444823158

Series: Handbook of Public Economics : Book 4

Published: 21st October 2002

Format: Hardcover

Language: English

Number of Pages: 702

Audience: Professional and Scholarly

Publisher: North Holland

Country of Publication: US

Dimensions (cm): 23.4 x 15.6 x 3.18

Weight (kg): 1.42

Shipping

| Standard Shipping | Express Shipping | |

|---|---|---|

| Metro postcodes: | $9.99 | $14.95 |

| Regional postcodes: | $9.99 | $14.95 |

| Rural postcodes: | $9.99 | $14.95 |

How to return your order

At Booktopia, we offer hassle-free returns in accordance with our returns policy. If you wish to return an item, please get in touch with Booktopia Customer Care.

Additional postage charges may be applicable.

Defective items

If there is a problem with any of the items received for your order then the Booktopia Customer Care team is ready to assist you.

For more info please visit our Help Centre.

You Can Find This Book In

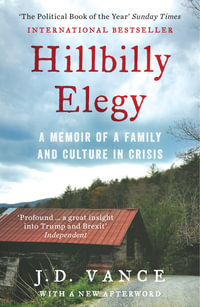

Hillbilly Elegy

The Internationally Bestselling Memoir from Trump's Future Vice-President of the United States

Paperback

RRP $24.99

$21.75

OFF

Think and Grow Rich (Bevelled Edge edition)

The Landmark Bestseller--Now Revised and Updated for the 21st Century

Not Supplied By Publisher

$22.35